Deciphering Financial Statements for Their Meaningful Data

Examining a company’s financial records can provide you a sense of its health and stability. The analysis of these statements is a fundamental practice in CORPORATE FINANCE, providing insights into a company’s profitability, liquidity, solvency, and operational efficiency. Financial statement analysis is made up of many various approaches, components, and critical ratios. The complexity and significance of this topic are discussed in great depth in this work.

Financial Statement Interpretation

In monetary terms, the three most crucial documents are the income statement, the balance sheet, and the cash flow statement. We can learn about a company’s overall financial health from each of these metrics, which are valuable in their own right.

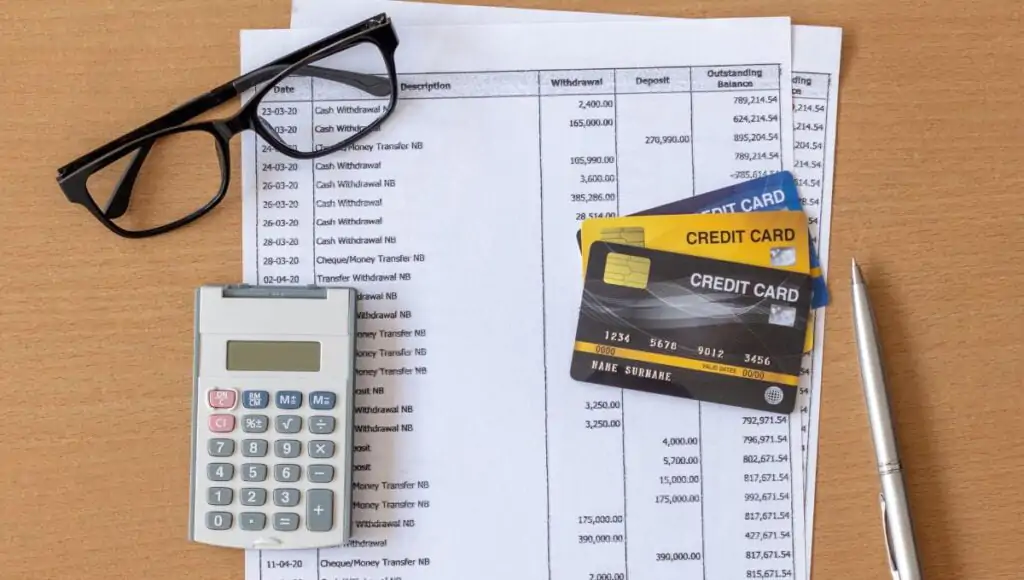

Financial Statement

A company’s assets, liabilities, and cash on hand are detailed in the balance sheet. Assets are equal to obligations plus owners’ equity, as is known from basic accounting. The report details the assets, liabilities, and expenditures of the company.

Income Statement

It details the revenue, expenses, and net profit of a business over a specific time frame. One name for the income statement is the profit and loss statement. Having a net income demonstrates that the company can turn a profit while maintaining cheap prices.

Financial Statement

It details the monetary inflow and outflow of the company as a result of activities such as financing, investing, and operating the firm. Profitability is critical for every business that wants to stay in business and pay its bills on time.

A variety of perspectives are available for analysing financial statements.

Looking at financial records in different ways can reveal different things:

Observe the lateral and vertical

“Horizontal analysis” is another name for this kind of study. It searches for trends and patterns in financial data by comparing it to data from different eras. In contrast, vertical analysis compares each component of a financial account to a base number to reveal its relative importance.

Examining Ratios

Financial data can be better understood using rate analysis. You may learn a lot about a company’s health in metrics like liquidity, profitability, and solvency by diving into its financial records. Using these ratios, you may compare your company’s performance to that of your competitors and industry standards.

Crucial Financial Statement Ratios

We can extract several valuable metrics from financial records, and we can utilise them for various types of analysis:

Rates of Cash Flow

- This ratio indicates the extent to which a company’s short-term assets can cover its short-term liabilities. More cash on hand is indicated by a larger number.

- It resembles the current ratio in many ways, but it excludes inventory from its definition of current assets. Because of this, it is a more reliable method for determining a company’s liquidity.

Financial Performance Measures

- You may find out your net income as a proportion of sales by looking at your net profit margin. Profitability is a measure of how successfully expenses are managed.

- The profit made by owners is revealed by the return on equity (ROE). A high return on equity indicates that the investment was profitable.

Financial Ratios

- To what extent does debt compare to equity? It reveals the ratio of a company’s funding sources (loans vs. owners).

- An essential measure of a firm’s financial health for those carrying substantial debt is the interest coverage ratio, which reveals the extent to which the company can meet its interest payments.

The effectiveness of a certain thing

-

Metric

- This metric, which measures the rate of sale and replacement, provides insight into the efficiency of inventory management.

-

Turnover of Receivables:

- This metric reveals the efficiency with which a business collects payments, which impacts its liquidity and capacity to fulfil its commitments.

The significance of reviewing financial accounts

In order to make informed judgements, many individuals require access to financial records. This includes managers, creditors, and investors. Customers are able to estimate their potential earnings with its assistance. Management takes a look at the company’s reputation while planning and making improvements, while creditors assess the company’s image.

Problems that surface when reviewing financial records

Looking at financial documents is not always fun, but it is worth it for all the knowledge you will get. There are a number of issues with this method, including the fact that proper comparisons require extensive knowledge of each business, the possibility of financial fraud, and the dependence on performance statistics from the past, which may not be indicative of future results.

I should mention that,

The ability to read and comprehend financial records is essential for anyone seeking employment in corporate finance. You can see the company’s financial statements health in these. In this way, students can decipher the meaning of the figures. Because of this, they will be able to make better management and investment decisions.

This article is sponsored by Living Animal